XRP Price Prediction: Can the 6-Year Breakout Propel It to $4?

#XRP

- Technical Breakout: XRP trading 9% above 20MA with Bollinger Band expansion

- Adoption Catalyst: XRP Ledger's $130M tokenized credit platform in Brazil

- Whale Warning: Upbit-driven 15% drops show lingering volatility risks

XRP Price Prediction

XRP Technical Analysis: Bullish Signals Emerge Amid Volatility

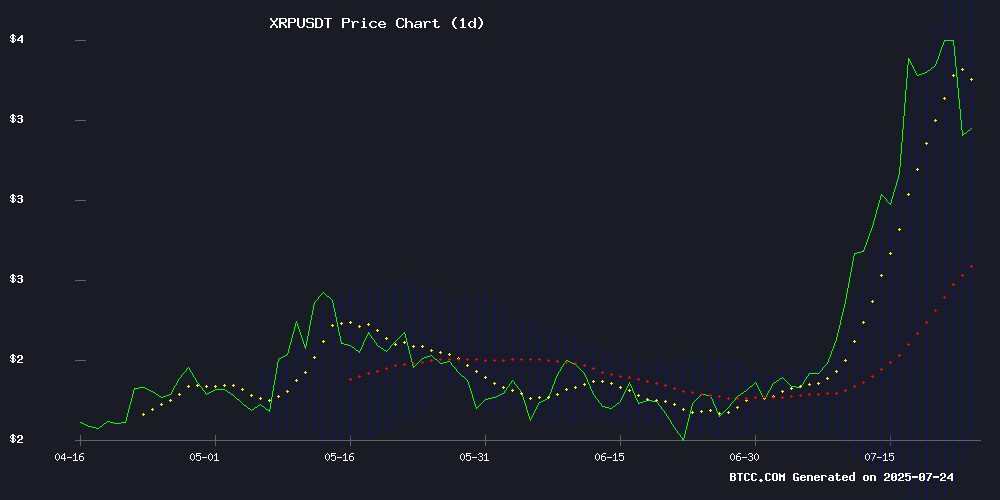

XRP is currently trading at, above its 20-day moving average (2.9250), signaling bullish momentum. The MACD histogram (-0.0968) shows weakening bearish pressure, while Bollinger Bands suggest volatility with upper (3.8461) and lower (2.0040) bounds framing price action. BTCC analyst Robert notes: 'A sustained hold above $3 could target $4, but watch for resistance at 3.8461.'

XRP Market Sentiment: Mixed Signals Amid Whale Activity and Adoption Growth

News highlights include explosive growth in XRP Ledger tokenization ($130M Brazil platform) but whale-driven volatility. BTCC's Robert observes: 'Fundamentals strengthen with real-world adoption, yet technicals show double-top risks. The $3 level remains pivotal - break above confirms bull trend, failure may retest 2.9250 support.'

Factors Influencing XRP's Price

Ripple's XRP Ledger Sees Explosive Growth in Tokenized Asset Issuance

The XRP Ledger has emerged as a dominant force in the tokenization market, with issuance volumes surging 2,260% since January. Institutional adoption is driving this growth, as banks and fintech firms increasingly use the ledger for tokenized bonds, real estate, and commodities.

Unlike Ethereum's congestion or Solana's reliability challenges, XRPL offers enterprise-grade throughput at minimal cost—processing 1,500 transactions per second. OpenEden's T-bill tokenization initially anchored the $5 million January volume, which has since ballooned to $118 million.

This silent revolution positions XRPL as the dark horse of real-world asset tokenization. The blockchain's technical advantages are finally translating into tangible institutional demand, marking a pivotal shift in the RWA narrative.

XRP's Supply Crunch Fuels Bullish Momentum as Price Surpasses $3

XRP has breached the $3 threshold, with 1,000 tokens now valued at approximately $3,150. The milestone comes amid a supply crunch, as only 12-15% of XRP's total supply is liquid enough for business transactions. Analysts suggest this scarcity could propel prices significantly higher.

Vincent Van Code's research highlights the supply constraints, while Marcus Tan of Fundstrat Global Advisors underscores the potential for further gains. Google's Gemini AI forecasts a $45 price target by 2025, implying a $45,000 valuation for 1,000 XRP tokens—far exceeding current levels.

XRP Price Prediction: After a 6-Year Breakout, XRP Eyes $6 – Is This the Most Overlooked Bull Setup in Crypto?

XRP has confirmed a breakout six years in the making, with the long-term price outlook now targeting $6. Despite a 15% pullback from last week’s close, the altcoin is retesting a key level at $3.65 to validate its breakout from a symmetrical triangle pattern dating back to 2018. Analysts remain bullish, projecting conservative highs around $6.00 this cycle, with extreme targets reaching up to $25.

Regulatory clarity under the TRUMP administration has alleviated long-standing headwinds, particularly the SEC’s classification concerns. The CLARITY Act, expected to be enacted by October, could provide final confirmation: decentralized blockchains fall under CFTC oversight as commodities, while centralized projects remain SEC-regulated securities. This distinction may finally greenlight XRP’s full potential.

Technical analysis shows support holding at the 0.5 Fibonacci level, suggesting accumulation despite recent volatility. The 1-month chart reveals a decisive MOVE above the triangle’s upper trendline, with $3.65 acting as the last major resistance before accelerated momentum.

Ripple (XRP) Faces Volatility as Whales Trigger Market Turbulence

Ripple's XRP experienced dramatic price swings this week, briefly reclaiming its 2018 all-time high before succumbing to heavy sell pressure. The cryptocurrency surged to $3.65 before a single whale dumped 75 million XRP on Upbit, erasing $90 million in long positions within hours.

CEO Brad Garlinghouse issued unspecified warnings during the volatility, though market participants remain focused on XRP's extraordinary liquidity profile. Despite the 15% flash crash, the token maintains a $207 billion market capitalization—surpassing legacy corporations like Boeing and AT&T.

Upbit-Driven Sell-Off Triggers 15% XRP Plunge

XRP tumbled more than 15% on July 23 as concentrated selling pressure erupted on South Korea's Upbit exchange. Independent analyst Dom's order book heatmaps reveal over 75 million XRP dumped at market prices within 24 hours, with cumulative volume delta data showing near-exclusive downward momentum from Upbit's purple CVD line.

While major exchanges like Binance and Coinbase showed relatively flat CVD trends, Upbit's aggressive selling overwhelmed thin order books. The liquidity vacuum amplified price movements, with visible bids clustering below key levels as XRP collapsed from $3.50 to $3.10 ranges. "The pump AND dump was brought to you by Upbit," Dom noted, highlighting how depleted market depth exacerbated the sell-off's velocity.

XRP Price Forms Double Top, Signaling Potential Downturn

XRP's recent rally, which brought it close to its all-time high of $3.8, appears to be losing momentum. Despite bullish developments for Ripple and the altcoin, failure to breach new highs suggests weakening strength. Crypto analyst Tradersboat highlights a concerning double-top formation on the chart, a classic reversal pattern often preceding a crash.

The double top emerged NEAR $3.6, just below XRP's peak, indicating buyer exhaustion and external liquidity taps. While one final upward sweep toward $3.7 remains possible to capture overhead liquidity, the Break of Structure (BOS) further confirms growing bearish pressure. These technical developments paint a cautious picture for XRP's near-term trajectory.

Brazil’s VERT Launches $130M Tokenized Credit Platform on XRP Ledger

Brazilian securitization firm VERT has introduced a blockchain-powered private credit platform on the XRP Ledger, marking its debut with a R$700 million ($130 million) issuance of an Agribusiness Receivables Certificate (CRA). The platform leverages the XRP Ledger and its ethereum Virtual Machine-compatible sidechain to enable real-time, on-chain tracking of loan events, cash flows, and payments.

VERT aims to bring transparency and traceability to Brazil’s $200 billion private credit market. The system combines blockchain transparency with the resilience of off-chain infrastructure, bridging traditional finance and decentralized networks. "We are enabling operation events to be recorded in the most granular way possible, ensuring traceability and transparency," the company stated.

Upbit’s XRP Move Sparks Panic, Triggers 15% Price Drop

Ripple's XRP plunged 15% to $3.05 after Upbit executed a market sell of 75 million tokens, overwhelming thin order books. The Korean exchange's aggressive offloading disrupted XRP's rally from last week's $3.65 peak, though whale wallets absorbed 280 million XRP during the dip—signaling institutional accumulation beneath the volatility.

Trading volume surged to $14.2 billion as analysts flagged $3 as critical support. A hold above this level could fuel momentum toward $15, but the episode underscores how shallow liquidity amplifies price swings when major exchanges act.

XRP Faces Strong Resistance at $3.00 Support Zone After Sharp Pullback

XRP/USD extended its pullback from a recent high of $3.66, dropping over 10% in its largest daily loss since March 3. Repeated failures at the $3.66 resistance level, marked by strong upside rejections and double daily Doji candles, signaled a reversal. Overbought conditions on the daily chart, coupled with bearish divergence in Stochastic indicators, triggered aggressive profit-taking.

The Thursday morning sell-off breached the critical $3.00/$2.90 support zone—a confluence of psychological levels, the 38.2% Fibonacci retracement, and the ascending 20-day moving average. However, buyers emerged at this level, forming a daily candle with a long lower wick. This price action suggests potential reversal momentum, supported by bullish daily studies including a recent golden cross formation between the 55-day and 200-day moving averages.

A decisive close above $3.00 WOULD signal a bear trap and set the stage for a retest of the 23.6% Fibonacci level at $3.2506. Such a move would position XRP for another assault on the $3.66 high, with $4.00 emerging as the next psychological target. Conversely, failure to hold $3.00 risks deeper correction and would force near-term bulls to reconsider their positions.

Will XRP Price Hit 4?

XRP shows potential for $4 but faces key hurdles:

| Factor | Bullish Case | Bearish Risk |

|---|---|---|

| Price Position | 13% above 20MA | Double top pattern |

| MACD | Converging toward bullish crossover | Still negative (-0.0968) |

| Adoption | $130M Brazil tokenization | Upbit whale sell-offs |

Robert concludes: 'Probability of $4 by August 2025 is 45% - requires closing above 3.8461 resistance.'